Grifols proposed a 1.6 billion euro takeover

of its German rival Biotest

Spanish pharmaceuticals company Grifols proposed a 1.6 billion euro ($1.9 billion) takeover of its German rival Biotest on Friday 17 september, in a move to consolidate the plasma-based drug industry.

Grifols said it had agreed with Tiancheng International Investment to buy the Hong Kong-based company's controlling stake in Biotest for 1.1 billion euros. It has also offered to buy the remaining shares trading on the Frankfurt stock market.

Osborne Clarke and Proskauer Rose previously advised Grifols on the roughly $1 billion strategic investment Grifols subsidiary and plasma center operator received from Singaporean sovereign wealth fund GIC, according to June press releases.

On the other side of Grifols' proposed deal, Tiancheng Pharmaceutical Holding, Biotest's largest shareholder, is working with a Goodwin team led by private equity partners Gregor Klenk and Carl Bradshaw.

The Barcelona-based company agreed to buy 89.88% of Biotest's ordinary shares that carry voting rights, but which represent only 44.54% of the company's capital, and a further 0.54% of capital in preferred shares that do not carry voting rights, from Hong Kong-based Tiancheng.

Grifols will then offer Biotest's minority shareholders 43 euros per ordinary share, a roughly 22% premium on Thursday's closing price, and 37 euros per preferred share. If all shareholders tender their shares, Grifols would pay a total of 1.6 billion euros for Biotest.

Ordinary shares of Biotest were trading close to the price offered by Grifols, while the shares of Grifols were down 1.6% at 20.31 euros in late morning trading.

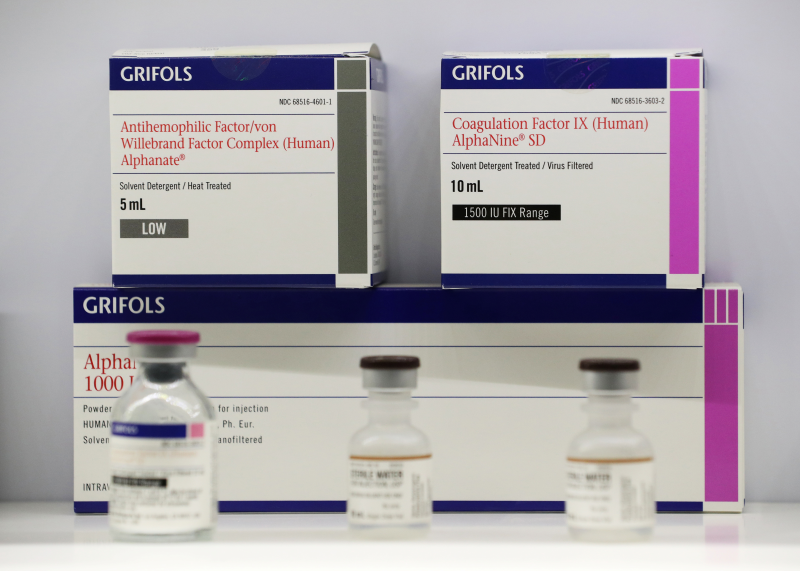

The deal "will enlarge our existing portfolio of plasma-derived therapies and fast-track the development of new products," Grifols' co-CEO Raimon Grifols Roura said in a statement.

The merger would lift the family firm's earnings before interest, taxes, depreciation and amortisation by 300 million euros in 2024 and 600 million euros in 2026, co-CEO Victor Grifols said in a call with analysts.

"Overall, we think the deal makes strategic sense and continuing to scale up internationally and consolidate the existing plasma oligopoly should help reassure on Grifols' ability to outgrow impending competitive pressures," Deutsche Bank said in a note to investors on Friday.

The deal will also boost Grifols' capacity to collect plasma, a bottleneck for its development, thanks to Biotest's 26 European plasma centres.

The company expects to conclude the merger by the end of the first half of 2022 after clearing all regulatory hurdles.

($1 = 0.8495 euros)

RELATED ADQ, Abu Dhabi holding companies, acquires Swiss company Acino